Inflation And The Impact On Your Money

My guess is you have heard the word lately from the news, your neighbor or even your barber. And if you haven’t then you have certainly been experiencing it every time you fill up your car with gas or visit the grocery store.Inflation is top of mind for so many across the country. Just check out the increase in Google searches on the word, which have been spiking in recent months: Google Trend for Inflation

But what is inflation, why is it occurring, how does it impact you and what can you do to combat it? We will briefly explore each of these areas. Don’t worry, I will keep this simple.

What is Inflation?

Simply put, “Inflation measures how much more expensive a set of goods and services has become over a certain period, usually a year.” There are many different measures of inflation. One of the most common that you may have heard is CPI or the Consumer Price Index. The most recent CPI reading for March was 8.5% higher than this time a year ago. That was the largest year-over-year increase since 1981.That means what cost $100 a year ago costs $108.5 today (on average – it does not apply uniformly to all goods and services) That is a significant jump! You may be thinking that inflation seems like a new phenomenon and depending on your age you may be right…in a way.

https://www.investopedia.com/terms/i/inflation.asp

A Brief History of Inflation

First, it is important to understand that modest inflation is expected and healthy. It means that the economy is in an expansionary mode. But inflation running too hot for too long can lead to a recessionary period. Key word CAN.The Federal Reserve – you have likely heard of them – has several jobs, one of which is to manage inflation. The Fed sets its target rate of inflation at 2%. As you can tell, we are well above that level which is not ideal.

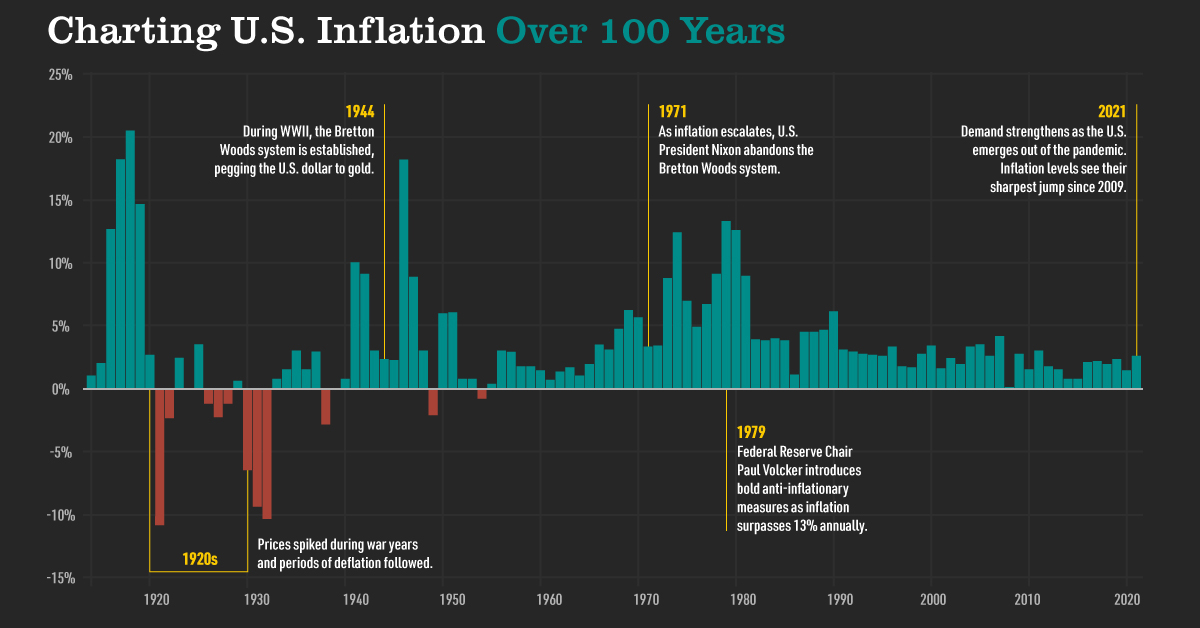

Inflation comes and goes in the economy and the reason why the current situation is new to so many is because for the most part, inflation has been modest for nearly 40-years.Sure, there have been periods of slightly higher inflation over that time, but nothing too serious.The last time that the U.S. experienced an extreme inflationary period was from the early 1970’s – early 1980’s. During this time inflation ran in the high single digits, even seeing double digit gains in 1974, 1979 and 1980. Before then you had to go back to the late 1940’s and early 1950’s to again see high levels of inflation.

As you can see, extreme levels of inflation are rare, but not knowing how extreme it will go or how long it will last is what causes major concerns

So Why is Inflation Occurring?

There are numerous factors causing inflation to rise.

- Years of government stimulus pumping money into the economy

- Record low interest rates fueling increased borrowing

- Supply chain issues first seen from Covid and further exacerbated by the Russia/Ukraine war

- Supply and demand imbalance on certain good and workers

- Rising wages

There is no one specific factor that is driving inflationary pressures. It is a culmination of many things occurring simultaneously.

How Does Inflation Impact You?

Inflation impacts us in many ways, from the prices we pay, stock market returns, bond prices, interest rate adjustments, real estate prices and more. So, lets break these down a bit.

Spending:

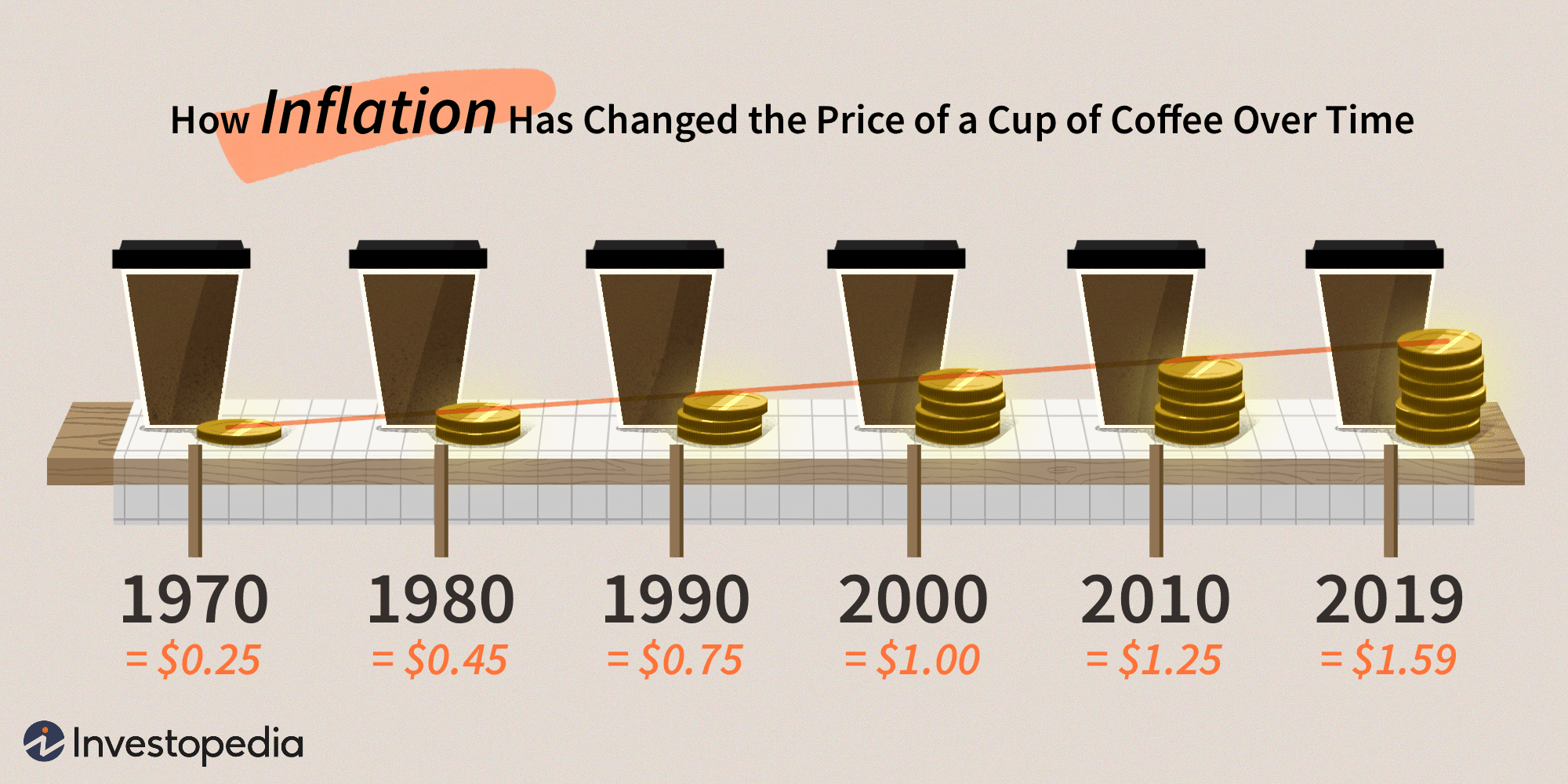

We already discussed the way that inflation impacts our consumption. The goods and services that we buy cost more, reducing the purchasing power of our income.

A recent study found that average consumers can expect to spend nearly $296 more per month! That is a big increase in expenses if you don’t adjust accordingly.

Stock Market:

Inflation tends to make the stock market more volatile, as investors are on edge about the economy.A stocks price reflects future expectations of that company. Therefore, there are certain parts of the market that perform better during inflationary periods as their businesses benefit from rising inflation (and subsequent higher interest rates). There are other parts that fare worse due to lower consumer spending, higher cost of goods sold and higher cost of debt servicing.

Still, stocks provide the opportunity to outpace inflation as opposed to money in the bank which is losing value to inflation since it earns little to no interest.

Interest Rates and Bond Prices:

As I previously mentioned, one of The Fed’s jobs is to try maintaining an inflation rate around 2%.

One way that they attempt to achieve that target is by raising interest rates. As interest rates rise, bond prices decline.

Therefore, if you own bonds in your investment portfolio, you may be seeing their value decline recently which might be quite shocking as you likely thought bonds were safe. Bonds still carry risk and can move up and down in value.

What Can You Do?

- Be flexible in your spending patterns. To absorb the increased cost of certain necessities, you may need to forego some discretionary spending such as eating out.

- Increase your income. There are many ways that you can bring in extra income to offset the increase in expenses.

- Diversify your investments. Timing the market and timing inflation are not going to work well. Investments react differently during various economic periods. Diversifying can help you avoid large losses while benefiting from other parts of the market that perform better during inflationary periods.

- Eliminate variable rate debt. With rising inflation comes rising interest rates, which can ultimately increase the interest rate on any variable rate debt such as credit cards. Fixed rate loans are safe.

Final Thoughts

It remains to be seen whether inflation will remain with us for some time or whether it will start to fade. There are “experts” with predictions on both sides. What is known is that it is something that you should take into consideration with your financial plan and investment strategy. You don’t want to be unprepared if it does stick around for longer than expected. Reach out today to learn how Crest Wealth Advisors can assist you in your financial planning, taking inflation and so many other factors into consideration.