What to do with your 401k when changing jobs

A job change can be an exciting time. Hopefully your switch was for good reasons such as a promotion, a higher salary, more upward potential, increased responsibilities, a reduced commute. The list could go on.

And even if it was for unexpected reasons, there is still a lot of change occurring.

But once you say goodbye to your former colleagues, pack up your things and head out the door, there is still one major decision that must not be forgotten…

What to do with your 401(k)!

You have several options when determining what to do with your old 401(k):

1.Leave your 401(k) where it is -Offers less flexibility and most people forget to pay attention to their account

2.Rollover your 401(k) to a new retirement account-Most often your best option for numerous reasons

3.Cash out your 401(k) plan–Avoid this option if possible due to negative tax consequences!

What Is A 401(k) Rollover?

A 401(k) rollover is when you request a direct transfer out of your old 401(k) plan to an IRA or your new 401(k). You will need to check with your new 401(k) provider to see if they accept rollover contributions. Not all do.

When you request a 401(k) rollover, all of your investments will be sold and converted to cash. You cannot transfer the investments “in-kind” in a 401(k)-rollover transaction.

Some 401(k) plans may be able to transfer the funds electronically directly to the new custodian where you want the money going. However, in many cases the 401(k) administrator will issue a check made payable to the new retirement account but sent to you, which you then have to forward along to the new account custodian.

Be aware of the 60-day rollover period! If your old 401(k) administrator issues you a check then you must take responsibility and send those funds to your IRA account within 60 days from the date the check was issued in order to avoid any taxation. If you miss this 60-day window, then you will incur federal and state income tax on the entire traditional 401(k) portion and potentially an additional 10% penalty if you do not meet other requirements.

Tax Implications Of A 401(k) Rollover

Assuming that you rollover your old 401(k) into an IRA or to your 401(k) plan with your new employer then there are no tax implications. This is a transfer from one tax-deferred account to another, allowing the money to be reinvested and continue to benefit from tax-deferred growth.

If you had different types of contributions into your old 401(k), such as pre-tax, Roth, or after-tax contributions, then you must be sure that you transfer each type of contribution to the appropriate account. This is to ensure that the account is treated appropriately once you do start withdrawing funds in retirement.

For example, Roth 401(k) contributions need to be rolled over into a Roth IRA or Roth 401(k). After-tax contributions should be rolled into a separate account for contribution tracking purposes.

Again, if you receive a check when going through the rollover process then be sure to satisfy the 60-day rollover requirement to avoid taxation. The importance of this cannot be stated enough.

Benefits of a 401(k) Rollover

There are many variables to consider when deciding what to do with your old 401(k). Here are 4 benefits of rolling over your plan to an IRA.

1.Increased investment options. Most 401(k) plans have a limited menu of investment options –typically in the range of 20-30 investments. The quality of these investments and the fees associated with each fund can vary greatly from plan to plan. When you rollover your 401(k) into an IRA you open yourself up to a much larger investment universe and therefore the potential to achieve better returns.

2.Simplify your life. Do not burden yourself later in life by trying to figure out where you have old 401(k) accounts and how to access those funds. By rolling over your 401(k) account you will have less accounts to worry about and you will have your assets in fewer locations,making it easier to stay up-to-date on your portfolio strategy. This also has the potential to boost investment returns since you will not have any old accounts sit stagnant and ignored.

3.Reduce fees. Your 401(k) may have fees that you are not even aware of. This includes fees such as account maintenance fees, administrative fees, potentially higher fund expenses and perhaps even a fee to a 401(k) advisor who you no longer get to benefit from by not being an active participant. You may not even be aware of these fees depending on how they are reported, but you can be certain that they are there.

4.Continue to contribute to the new account. Once you leave your employer, you are no longer able to contribute to the 401(k) if you leave it where it is. Therefore, the account will not benefit from future contributions. Taking your account with you to an active retirement account where you can continue to contribute, such as an IRA or new 401(k), allows you to continue making contributions.

Avoid Cashing Out Your 401(k)

It might be tempting to cash out your 401(k) and use that money. Unless you are in a serious financial situation where you need the money for very good reasons, it is best to avoid this option.

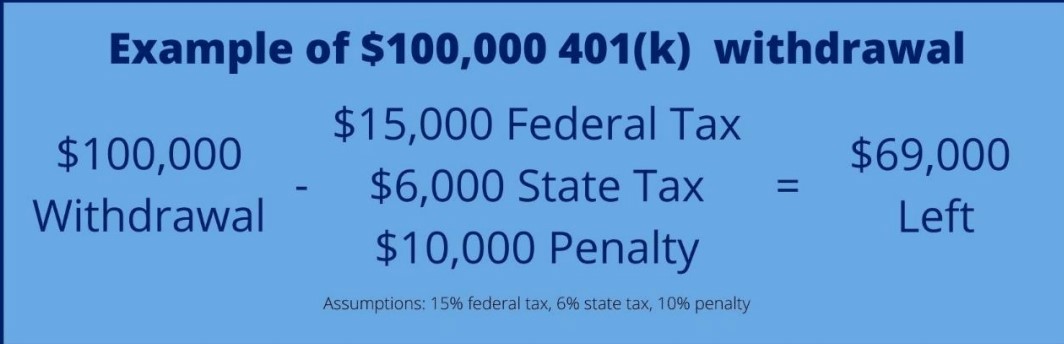

Not only will you owe federal & state income tax on the entire amount that is cashed out of a traditional 401(k), but you may also owe an additional 10% penalty depending on your specific situation. That means taxes and fees could add up to over 40% in some situations!

Most importantly, by cashing out of your 401(k) are foregoing two of the greatest benefits of retirement accounts: time and tax deferred compound growth. These two forces can make your money multiply significantly! Do not interrupt them!

Additional Considerations

401(k) plans are customizable by the employer and therefore each plan may have different characteristics. That is why it is important to understand the following:

1.Will your old 401(k) plan even allow you to keep your account there after you are no longer with the company?

2.Will your new 401(k) plan allow for rollover contributions?

3.Are the investment options in your new 401(k) plan any good?

4.Do you have the time and desire to personally manage your investment portfolio in an IRA or should you seek professional assistance?

5.Do you have employer stock in your old 401(k) plan? This requires much more planning as to the most appropriate strategy.Every persons situation is different and therefore there is no one size fits all answer. Rolling over your 401(k) to an IRA has many benefits, as discussed here, but the decision requires thoughtful analysis and consideration.

Final Thoughts

Do not take this decision lightly. There are a lot of factors to consider and there is a lot on the line with this decision. But not making any decision at all and simply forgetting about your account and letting it sit dormant for years could turn out to be one of the worst decisions.

If the thought of all of this overwhelms you then seek professional guidance. A financial advisor can assist you in analyzing this decision and facilitating the process. Additionally, an advisor will help you manage the Rollover IRA account if this is not something you have the time or interest in taking on yourself.Schedule a call today to discuss how to best navigate your old 401(k) options.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jason Dall’Acqua, and all rights are reserved