Stock Markets Experience A Difficult Start To The Year

This is no secret. In fact, you are probably reminded of it quite often with news headlines.As ofthemarket close on 2/22/2022 the S&P 500 is down 10.25% since 12/31/2021 while theNASDAQ is down 15.48% over the same time period.Declines such as these feel uncomfortable as they occur and can lead us to making emotional,reactive decisions. It is our money at stake after all!However, it is in these exact moments that we must put things into perspective and understandwhat we should be focused on and what is within our control.

A Brief History of the S&P 500

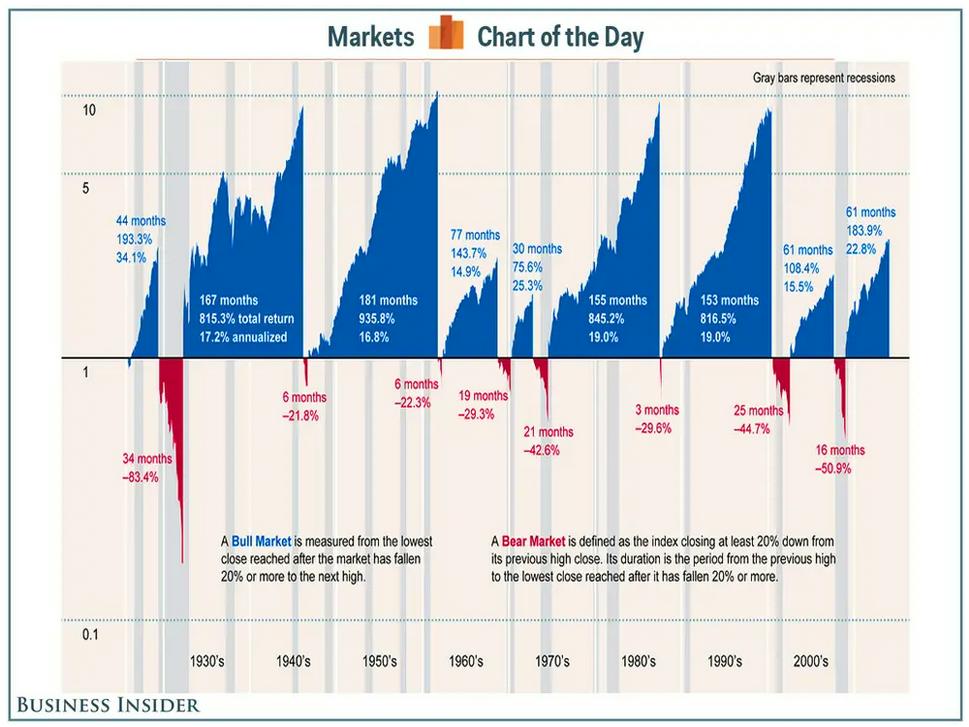

Let’s first consider what has been occurring inthe stock market over the past 12 years.US stock markets have been experiencing one of the strongest periods in history, with the onlynegative year since 2009 occurring in 2018.Don’t forget, this includes the COVID-19 market meltdown in the early spring of 2020 that saw the S&P 500 decline by roughly 34% in a matter of weeks and the Dow Jones decline by 12.9%in a single day! The S&P still ended up 16.26% for the year.And while declines like those we experienced in 2020 were extreme–especially in such a shorttime frame–the declines we are experiencing so far this year are not out of the ordinary.

In fact, on average, a decline of 10% – 20% in the S&P 500 occurs once every 2 years. A decline of 20% – 30% occurs once every 7 years. While we may feel sick to our stomachs during the decline, they are not uncommon. What isuncommon is the historic rise that we have been experiencing without much in the way of declines.

Ways to Handle Market Volatility

Create a plan specific toyour financial situation

This starts by understanding what you are trying to accomplish with your investments. Are you looking for growth or income? Are you looking to outpace inflation or protect your principal? There is no right or wrong, there is only what is right for your specific situation. For example, the investment strategy of a high-income couple in their 30’s should not look the same as a couple in their early 60’s thinking about retiring in a few years. Your investment plan needs to be designed around you. Your goals. Your needs. Your risk tolerance. Your time horizon. The biggest mistake that you can make is to not have a plan in place. Not only that, but a plan based on discipline and strategy, rather than speculating about the next hot Reddit stock.

Avoid Making Emotional Decisions

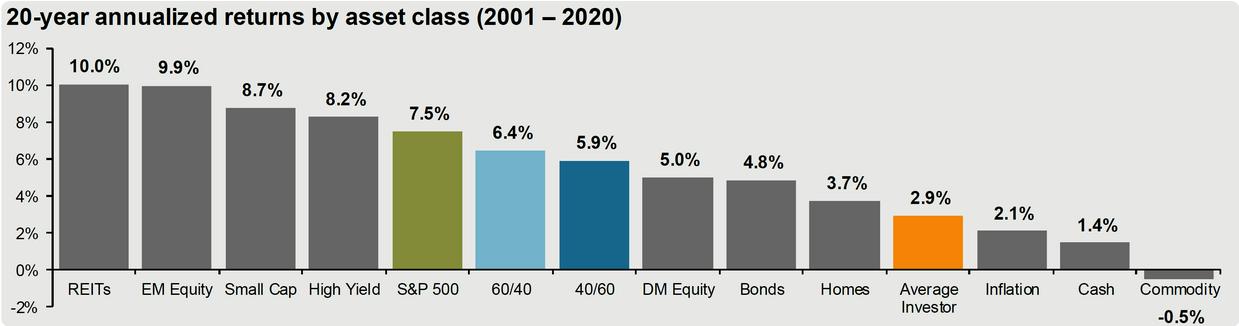

Individuals tend to act against their best interest. We know we should workout, but we hit the snooze button for more sleep. We know we shouldread to learn more, but we turn on Netflix for hours. The list could go on for days.The same is true when it comes to investing.We may know that we should stick to our plan –assuming we have one in the first place–but during times of market unrest we want to take action to make it feel like we are helping ourselves.That action often means selling. And because timing the market is nearly impossible, that selling is likely to occur after the market has already declined. Not only that, but we tend to not know when to get back into the market, often buying back in after the market has rebounded above where we sold at. Selling low and buying high is not a recipe for success. But it is very common among individuals. That is why from 2001–2021, the S&P 500 averaged 7.9% per year while the average individual averaged 2.9% per year. That is a huge difference!

Market declines can actually be an opportunity to buy stocks at lower prices, assuming you havea long-term perspective and feel good about the potential future.

Focus on the Long-Term

Investing involves risk. It is not for the faint of heart. But it is a critical part of building wealth and achieving your long-term goals such as retirement. Which is why we must maintain a long-term perspective – assuming a long investment time horizon.Stocks rise much more often than they decline – reflected in the fact that the average annual return for the S&P 500 going back to 1926 is roughly 10.33% per year before inflation. Just take a look at the chart below, showing periods of rising markets versus periods of declines.

Final Thoughts

In the words of Benjamin Graham – “The individual investor should act consistently as an investor, and not as a speculator.”If we want to benefit from the long-term returns of the market then we must be willing to accept the short-term volatility that we are bound to experience. The best way to manage these difficult periods is by first having a plan in place, sticking to that plan, managing our emotions and keeping a long-term perspective. While it is not rocket science, it does involve a tremendous amount of discipline and willpower.

If you lack confidence in your plan then reach out to Crest Wealth Advisors today to learn how we can assist you in aligning your investment strategy with your long-term goals.