Taxes in Retirement – Planning and Coordination

Planning your income during retirement requires focusing on the different tax characteristics of your assets and income sources. If you aren’t careful, your tax liabilities could be higher than you anticipated, leaving you with much less money than you expected during a time you need it the most.Rather than letting your tax liabilities reduce your retirement income, consider these strategies for taxes in retirement.

Taxable Income During Retirement

Everyone has different sources of income, but some of the most common taxable income sources during retirement include:

- Social Security

- Pre-tax IRA funds

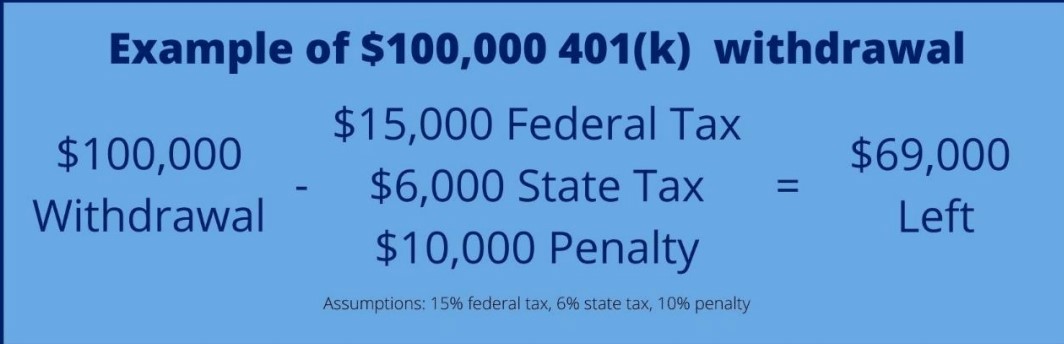

- 401K withdrawals

- Pensions

- Inherited IRA withdrawals

- Annuities

- Interest

- Dividends

- Capital gains

- Passive income from sources like real estate

The only income that likely won’t incur a tax liability is income from a Roth IRA or 401K. As long as you’ve owned the account for at least five years and withdraw funds after age 59 ½, your withdrawals are tax-free.All other sources of income discussed above, though, will incur tax liabilities. So how do you strategically receive income during retirement to reduce your tax liabilities?

Minimizing Taxes During Retirement

To minimize your taxes in retirement, here are a few strategies.

Social Security Claiming Strategy

Avoiding taxes on your Social Security income is legal, but it requires careful planning. The only way to avoid paying taxes on Social Security is to ensure your combined annual income doesn’t exceed $25,000 if you’re filing single and $32,000 if you’re married filing jointly.To determine your combined annual income, you must consider the following:

- Adjusted gross income from any earnings except Social Security

- Tax-exempt interest income

- 50% of your Social Security income

If you can keep your income lower than $25,000 or $32,000, whichever applies to you, then your social security benefit is not taxed.You will pay income tax on the following portion of your benefits once your income exceeds those amounts:

- 50% of your benefit if income is between $25,000 – $34,000 if you’re filing single or $32,000 – $44,000 for married filing jointly.

- 85% of your benefit if your income is above $34,000 if filing single and $44,000 if married filing jointly.

To manage this, try to limit how much you withdraw from taxable retirement accounts or wait to take your Social Security income until you’ve hit the years when your other income is lower.

Diversify your Investments into Different Tax Buckets

When you invest for retirement, you have different avenues you can take. Not everything must go into an IRA or 401k. If you want to lower your tax burden during retirement, consider Roth accounts if your income isn’t too high to qualify for it. The limits are $138,000 for single filers and $218,000 for married filing jointly couples to contribute the full amount allowed. As you go above those amounts, the amount you can contribute to a Roth IRA decreases, phasing out completely at $153,000 and $228,000 respectively.When you have Roth accounts, you can withdraw when you want because you’ve already paid the taxes due on the income. Don’t forget about taxable brokerage accounts. These accounts offer liquidity, flexibility and different tax characteristics than Roth and Traditional retirement accounts.

It’s important to have your retirement funds in different tax buckets so you aren’t stuck with Required Minimum Distributions and paying large amounts of tax when you can least afford it.

Focus on Long-Term Capital Gains

Try keeping your investment gains to only be taxed at long-term capital gain rates. All this required is holding an investment for more than 1-year before selling it at a gain. Short-term capital gains are taxed at ordinary income rates based on your current taxable income, but long-term capital gains are taxed at preferential lower rates, saving you money.

Consider Roth Conversions

If your income exceeds the limits to contribute to a Roth account, or you didn’t consider it when you opened your retirement account, consider a Roth conversion.With a Roth conversion, you convert your existing traditional retirement account to a Roth account to get tax benefits and avoid RMDs. When you convert, you pay taxes on the income today but can withdraw contributions and earnings tax-free during retirement.While you’ll pay a lump sum for the taxes owed today, you won’t pay taxes in retirement, which diversifies your income and allows you to avoid excessive taxation during retirement. Roth conversions should be strategically timed to ideally be done in years that you are in a lower tax bracket than when you made the tax deductible retirement contribution.

Tax Efficient Investing

Tax-efficient investing is just as it sounds – owning specific types of investments in the most appropriate account in order to reduce tax implications. Rather than losing a large portion of your earnings to taxes, learn how to minimize your taxes and maximize your earnings.While there’s no guarantee how investments will perform, the following strategies can help minimize your tax liabilities during retirement.

For example, in taxable accounts, consider holding:

- Stocks you own for more than a year to take advantage of long-term capital gains, which are usually taxed at a lower rate than short-term capital gains

- High growth potential investments

- ETFs and index funds that limit capital gain distributions

- Investments that pay qualified dividends

- Municipal bonds

In tax-advantaged accounts, consider the following:

- Income oriented investments

- High growth potential investments (in Roth accounts)

- Actively managed funds

- Taxable bond funds

- REITs

Strategize your Retirement Account Withdrawals

To minimize your tax liabilities in retirement, you need to strategically choose what accounts you take withdrawals from and when.Traditional retirement accounts require you to withdraw a minimum amount of money annually starting at age 73. This is to ensure you pay taxes on the funds you deferred. However, before then, you can withdraw funds how you please.Following your RMD – Required Minimum Distribution – you can supplement any additional income needs from taxable accounts followed by tax-free accounts. If you have not yet reached the age for RMD’s then you may consider drawing first from taxable accounts, followed by tax-deferred accounts then tax free. You want to try timing your tax-deferred withdrawals for the years that you are in the lowest tax bracket.

Final Thoughts

Planning your taxes in retirement is just as important as saving money for retirement. If you’re not careful, your taxes could overtake your earnings, leaving you with much less than anticipated in retirement.Instead, strategize your tax plans during retirement so you don’t have any unpleasant surprises or are left without the funds you need. Diversifying your accounts, withdrawing from funds that tax the least, and carefully withdrawing funds from taxable accounts during years when you’re in a lower tax bracket are the best ways to ensure you have maximum earnings and the lowest tax burdens during retirement.