How to avoid taxes when investing

Taxes and Your Investments

Do you truly enjoy paying taxes? I am going to assume that your answer is no. Most people that I know would rather keep more of their hard-earned money in their pocket.

So how can you attempt to control the amount of taxes you are paying on your investments? Fortunately, there are several strategies to assist!

What are the different ways that an investment incurs taxes?

It is important to keep in mind that we are discussing the way stock and bond investments incur taxes in taxable (non-retirement) accounts. Retirement accounts, such as IRA’s and 401k’s are an entirely different story.

Investments can incur taxes in 3 ways:

1.Capital gain upon sale–Occurs when the sale price of the investment is higher than the purchase price. Capital gains can either be short-term or long-term. Short-term investments are owned for less than 1-year; long-term investments for more than 1-year.

2.Capital gain distributions–If you invest in a mutual fund or ETF (Exchange Traded Fund) then the fundmay pay out capital gain distributions, typically at year-end.

3.Dividends & interest–Paid monthly, quarterly or annually from fixed income (bond) investments and dividend paying stocks and stock funds.

Each of these taxable events can be taxed at different rates. This is where things can get confusing.

1.If an investment is held for less than 1-year and sold at a profit, then it is a short-term capital gain(STCG). The gain will be taxed at your marginal ordinary income tax rate.

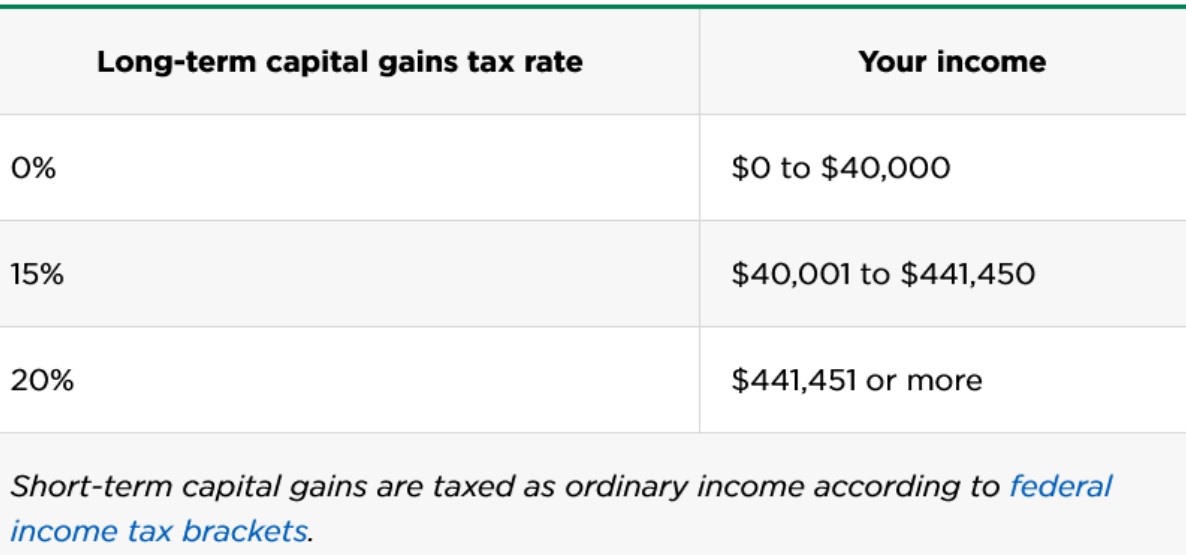

2.If an investment is held for more than 1-year and sold at a profit, then it is a long-term capital gain(LTCG). The gain is taxed at a preferential lower rate, which is based on your ordinarytax bracket. These rates range from 0 –20% depending on your income level1.

3.Capital gain distributions from mutual funds operate similarly, where the distribution from the fund will be classified as either a STCG or a LTCG. Without getting into the mechanics of how a mutual fund works, these capital gain distributions are generally outside of your control.

4.Interest income from fixed income investments is generally taxed as ordinary income. There are exceptions to this, which we will discuss later on.

5.Dividends may be taxed at either preferential LTCG rates or as ordinary income. It depends on whether the dividend is qualified or non-qualified.

Source: Nerd Wallet

Are there ways to minimize investment taxes?

Short answer…YES. It is important to note that in some cases, foregoing taxes in the short-term may mean larger tax consequences in the long-term. Tax planning is a balancing act and requires frequent review. One of the simplest ways to reduce your tax burden is to hold an investment for longer than 1-year. In doing so, your capital gain tax rate is reduced to lower preferential rates. For long-term investors this should be no problem.Alternatively, certain types of investments have tax advantages. This includes:

1.Municipal bonds–Bonds issued by state and local governments of the state in which you reside. These bonds are federal and state tax exempt if purchasing a bond issued from your state of residence. Contrast this to corporate bonds, which are taxable at both levels, and US government bonds, which are taxable at the federal level. Municipal bonds may pay lower interest rates due to this tax benefit. Therefore the tax benefit will likely depend on your income level and marginal tax bracket.

2.Exchange Traded Funds (ETF’s)–The first US ETF was launched in 1993 making this a newer investment vehicle than mutual funds. ETF’s offer the benefits of a diversified basket of stocks, while largely avoiding capital gain distributions. ETF’s still incur capital gains if the investment is sold at a profit.

Additionally, a loss on the sale of an investment can be used to offset the gains from the sale of other investments.

For example, if you have $10,000 in gains from the sale of investments and $4,000 in losses from sales, then your total taxable gain is only $6,000 ($10,000 -$4,000). In fact, you are allowed to offset all of your capital gains, plus an additional $3,000 per year in ordinary income by taking losses! Any additional losses will need to “carry forward” to future years.

Does the type of account an investment is held in impact taxation?

Absolutely.

Up to this point we have been discussing the tax implications of investments held in taxable accounts.

Retirement accounts are an entirely different story. Interest income, capital gain distributions and capital gains from sales or not taxable in the year they areincurred. Retirement accounts grow on a “tax-deferred” or “tax-free” basis depending on what type of retirement account it is. You may owe ordinary income tax once you start taking distributions from these accounts, but that will be dependent on what typeof retirement account it is. More on this in another article.

A well-planned investment strategy should take taxes into consideration. It is not the only consideration in an investment plan, but it is an important one. As you can see there are a lot of moving parts. Be sure to consult with your financial advisor or tax professional when determining your tax consequences.

If you are looking for a financial advisor who can provide a tax-efficient investment strategy, then schedule a call today!

Disclaimer: This article is provided for general information and illustration purposes only.Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourageyou to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jason Dall’Acqua, and all rights are reserved.